|

|

| Home › Articles › Here |

|

|

||||||||||||||

| The End Of Press Bubbles |

|||||||||||||||

| By: Nick Howard | Date: October 2010 | Contact the Author |

|||||||||||||||

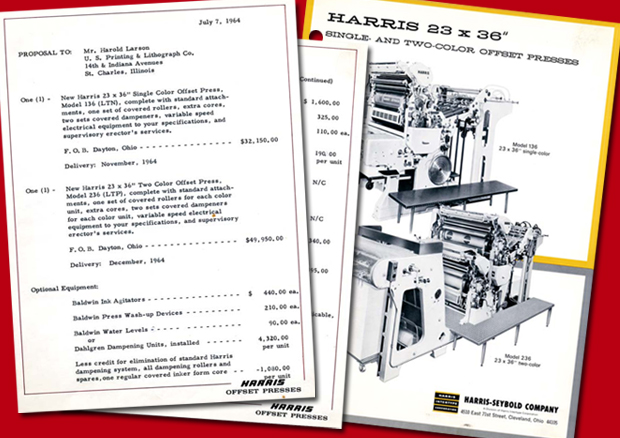

| The Harris-Seybold Company on July 7,

1964, presented a quotation for the

following press: |

|||||||||||||||

|

One (1) New Harris 23 x 36", Two Color Offset Press. Model 236 (LTP), complete with standard attachments,

one set of covered rollers for each colour unit, extra cores, two sets covered dampeners for each colour unit,

variable speed electrical equipment to your specifications and supervisory erector’s services. F.O.B Factory, Ohio: . . . . . . . $49,950.00 |

|||||||||||||||

| A printer would then pay another

$4,320.00 per unit for Dahlgren, if they

chose this option. Not much in the way of

automation on this press, manual everything

included. It is incredible that this new

press was surmised in a 6-line quotation,

particularly when compared with today’s

massive quotations that can easily fill a 3-

ring binder. I am referencing this Harris-Seybold quotation because it speaks to an important capital investment issue now faced by most commercial printers. Clearly, everyone knows that equipment prices have dramatically changed over time and perhaps, based on the 1964 dollar (US or CAD), you would view this Harris LTP press as a major investment, while others may not. To me the intrigue is that there is no mention of payment within the 4-line quote. This is because, in the 1960s, the printer bore full responsibility for getting a loan, or whatever means they chose, to fund the press purchase. Press makers did not get involved in the financing end of the business, that was your problem. Of course, that was then... but, as recent changes in the world of finance have revealed, the printing industry may be finding its way back to the days of 1964 in terms of having to fund their own press purchases, or any major equipment purchases for that matter. Although there were cases of shortterm payments through promissory notes, long-term finance was held exclusively with the financial sector. During the Golden Years of printing, the need for machinery ruled the market. Printers had tons of work, and, beyond localized radio and TV, clients had no viable alternatives for getting messages out beyond printing with ink on paper. Then when the ’70s rolled around, companies in the United States spearheaded a major step in business evolution with all sorts of banks and leasing companies getting involved with finance. Leasing matured as a means to fund expensive equipment, either on or off the balance sheet. As time went on, particularly in the U.S., equipment vendors and finance companies started to work together very closely. Suddenly, their investment presentations included not only the machine but also several ways in which to pay for it. A new printing equipment sales tool arose. By leveraging the resources of financial organizations, press manufacturers concluded they could sell more equipment, earmark more monies toward research and development, and ultimately make the printer more profitable. It appeared to be a winning formula. Printers started to expect that their vendor would arrange or at least introduce finance into the purchase agreement. Not so much back in 1964. Those guys had to go calling on their banks to get funding. Credit flow and press makers Suddenly, with press makers and financing companies working so closely together, there was enormous potential for printing companies to grow very quickly. Remember this was the Golden Age of printing, and there was so much work around, including much more 4-colour work, that printers were really only restrained by their own ambitions. The capacity of any new press could be filled easily enough if the company made likewise investments in its sales force and other key internal mechanisms. A machine that would have never been possible to get a loan for now became a reality. Maybe a sheetfed printer who felt the allure of web offset now could actually put one on their floor and take a run at the big guys. And in fact, this happened a lot 20 to 30 years ago. Think about the meteoric rise of a company like Transcontinental, which is still a relatively young organization. The ability to construct initial finance along with great management and a willingness to grow, propelled Transcontinental into a leader not only in Canada but North America. Finance or the ability to raise it is an important ingredient of a successful company. Of course, while some printing companies became very successful, others either went bust or had to downsize to stay in business. Finance also made mergers and acquisitions possible. It was not 100 percent cash that funded a small Quebecor company when they bought Ronald’s Federated, Maxwell Communications or World Color. Now, fast-forward to 2008. With all the cheap and easy access to credit one could imagine, things were going along quite nicely until both the quantity and the profitability of printing changed. Up until a few years ago, almost anyone in Canada could finance a press. Even startup companies with no sales, or perhaps a company that had been brokering print with under $1 million in sales, were placing orders for machines in the $1 million to $3 million range. |

|||||||||||||||

|

|||||||||||||||