|

|

| Home › Articles › Here |

|

|

||||||||||||||

| The End Of Press Bubbles |

|||||||||||||||

| By: Nick Howard | Date: October 2010 | Contact the Author |

|||||||||||||||

Cont'd from Part 1 |

|||||||||||||||

|

Bespoke finance companies were rubber

stamping deals based on limited fundamentals

of the end-user and relying mainly on the seller to backstop the deal

in the form of postponements called

“recourse.” When printers could turn out

enough work, this situation was viable and

the monthly payments were met. But it got

even better. Payment delays in the form of

reduced or initial payments were back

loaded and placed at the back end of a finance

package. Nothing is free right? Add

to this the 96-month lease and, in hindsight,

we all start seeing a problem was

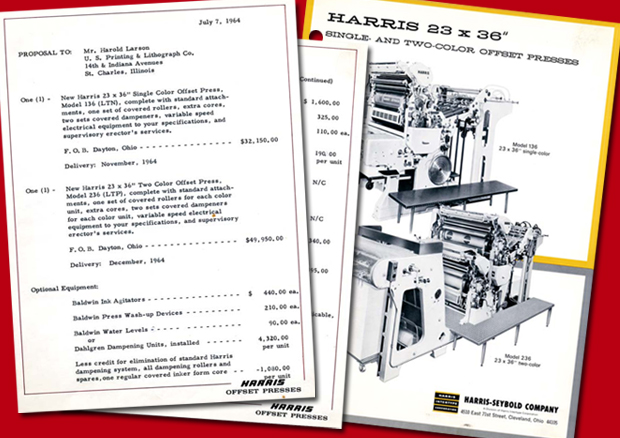

arising that would have to be answered for. The financing hunt The ability of financing companies to be flexible was a really good thing. It is the major reason why the print industry has developed so quickly and also in many cases, stayed profitable. This environment took hold in a myriad of other manufacturing industries too. But this is a bubble effect and bubbles tend to burst at the worst times. Many of you know firsthand that maintaining press payments is increasingly difficult these days. Can financing still be located? This is a really topical question. Now is a good time to understand what our banks and the like need to get a deal done. There is one major factor that all of these number crunchers look for in a company: Cash flow, the ability for a company to generate enough cash to pay for whatever they are buying. This is critical to understand because banks already know times are tough across most manufacturing sectors, and they all perceive the printing industry to be in the throes of major change. Banks have been dealing with printers for decades and have a good handle on this industry, on its maturity even relative to the other major manufacturing sectors. Banks can be sympathetic to a bad year, almost expecting to see ebb and flow reflected on the balance sheet. But without cash flow, printers really have a hard time getting an approval. Large finance companies that provide what is called asset-backed finance also look for the same thing. Another key point to improve your access to finance revolves around a concerted effort to keep your books up to date, and clearly showing that you have taken steps to reduce overhead or cost of sales. Certainly this is not a new situation, but it is especially relevant today. As well, if the employment structure of a modern printing company resembles 1964, well, there is a big problem. Because as we all know the mechanics of printing are so much simpler today (some may disagree), it only makes sense that the 1964 or even 1990 printing company structure must also change in terms of personnel. Everything from the receptionist to the link between a general manager, pressroom supervisor, lead press operator, must change. In this trifecta, one of the three positions probably is no longer needed. And certainly the operator cannot be counted out. . . Margin revisited Back in ’64, the printer had to do all the arranging and this usually meant a capital lease or traditional equipment loan that maxed out at four to five years. The printer would have had to put down a sizable percentage of deposit, usually a minimum of 25 percent, and write a business plan. The printer was required to show that they could afford to fund their new press from profits. We are back there again. For the few printers always strong enough to get their own deal done, this should be good news indeed. As for the rest, it means a much more difficult time getting funding. But at the end of the day, this new financing environment has the makings to build a stronger industry. Not because the strong can charge whatever they like! That environment will never happen. But because there will be fewer start-up companies that have no skin in the game. When you have a lot of your own money and or personal guaranties at stake, the tendency to go after work just to get it without margin, is somewhat diminished. There is a personal risk. I have always been amused when thinking back to many transactions that ended up being new deals when they should have been used purchases. The funder would regale a printer with the need for new as it was easier to fund (higher net value at end of lease). The printer could actually get funding for a new machine that was sometimes two or three times more expensive compared to a machine that was used. Even now there are printers who clearly cannot afford the equipment they have and some even hurt the rest of the industry by desperately trying to hold on to these machines. Awash with overcapacity some tend to undersell themselves: Look at running speeds and make-ready times as something that needs to increase and decrease at the same time. Without generating profitability by these two basic yet essential prerequisites how does one convince or even show on paper an ability to handle big monthly payments? There is still an incredible amount of print out there. The work is still to be had, but it must be manufactured at lower production costs. Printing equipment needs have never been more important than now, in that high-tech, automated equipment is an absolute must. A printer cannot expect most older machines to cope with the downward pressure of print pricing and so it remains that finance, instead of being a problem, can be somewhat of a benefit to those who understand and can make it work. There will come a time when it will be easier to gain funding for deals. But it can be of great encouragement to know that you are dealing with competitors that are like you and will not give away print because they received a rubber-stamped, easy-credit finance package. There are no longer special or free perks in any finance deal. Some may think so, but sooner or later everyone pays – No one rides for free! |

|||||||||||||||

| Contact the Author | |||||||||||||||

|

|||||||||||||||